Enable charging tax on shipping cost

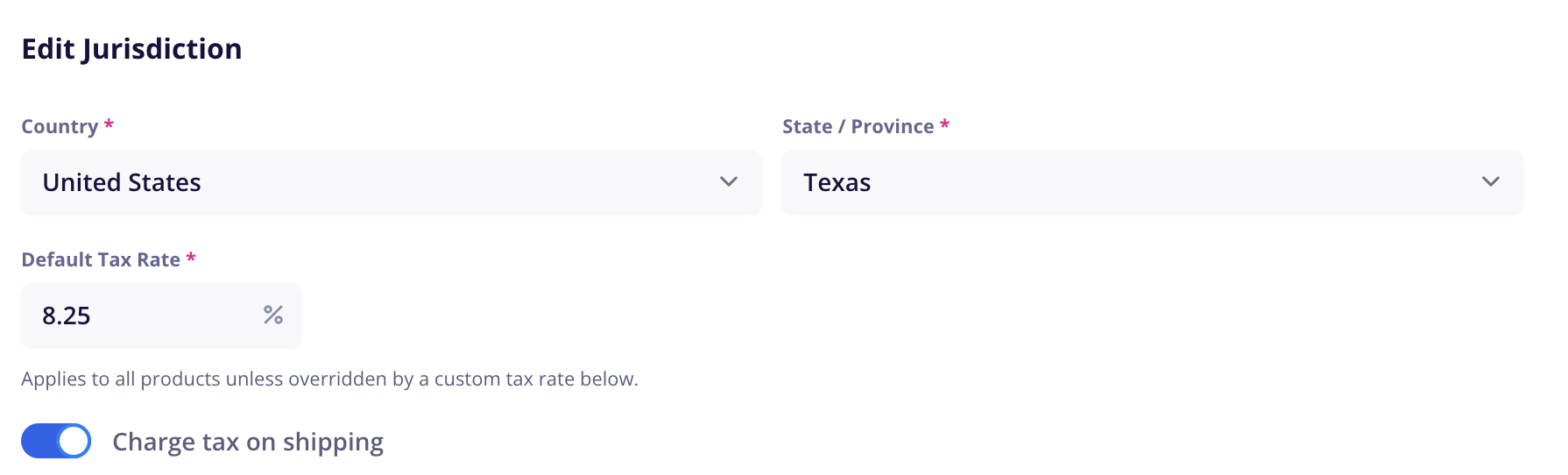

To enable taxes on shipping charges, go to your tax settings and open up a taxable jurisdiction (or create one if you haven’t done so already).

Go to Tax SettingsEnable the checkbox to “Charge tax on shipping”

How is shipping tax calculated?

We calculate taxes on shipping charges by multiplying the order shipping cost x the default jurisdiction tax rate.

So in the case above, any charges for shipping would be taxed at 8.25%. This amount is added to the shipping line item at checkout and is not seen separately.

Example:

$100.00 item

$10.00 shipping

$9.08 tax (8.25%)

= $119.08 total costNote: Product level taxes and shipping taxes are calculated separately. If a customer purchases an item in a tax class with a unique tax rate (ex: 20%), taxes on shipping will still be charged at the default tax rate for the jurisdiction (ex: 8.25%).

Should I be charging taxes on shipping?

Avalara has a shipping tax guide for each U.S. state. Read more here.

We recommend consulting a tax expert if you have any questions for your specific jurisdiction, products, or business.