If you’re shipping products across international borders, you might need to fill out customers forms for your products with their HS code and Country of Origin. CartGenie has implemented a way to add these bits of info to your products to make this process simpler.

Open your CartGenie products and click in to edit an item.

Go to the “Billing & Shipping” tab and enable the “Yes, this product requires shipping” toggle.

Now, enable the toggle for “Add customs info for international orders”

You will now see 2 fields to insert the product’s HS code and Country of origin.

CartGenie will only display the HS Code and country of origin on orders when:

Customer’s Shipping Country ≠ Your Shop’s Country in Business Info Settings

The idea here is that you do not need to see the customs info if you are not shipping internationally. So it will not show up on any domestic orders.

CartGenie makes it very easy to utilize this information when you need it most. Customers do not need this information themselves, so we prioritized displaying it on backend interfaces.

Note: CartGenie cannot send HS code and Country of Origin directly to Shippo due to Shippo’s current API limitations unfortunately.

If you open an order from an international customer in CartGenie’s order dashboard (after adding customs info to a product), then you will see it displayed right in the order detail line item alongside any variant information.

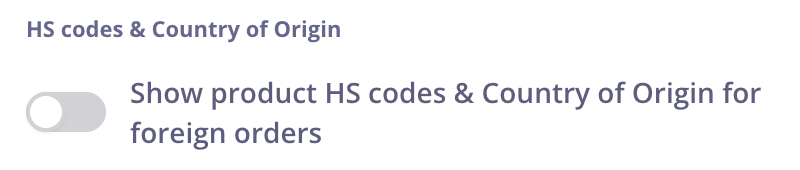

The “Order Received” Email is the one that is sent to you when an order is made by a customer. We will display the customs information in the email if the “HS Codes & Country of Origin” option is enabled in the Communication Settings page > Order Received email editor.

We will display the customs information in the PDF invoice & packing slip if the “HS Codes & Country of Origin” option is enabled in the Communication Settings page > Invoice (or Packing Slip) editor.

An HS Code (Harmonized System Code) is a standardized international code used to classify products for customs, tariffs, and shipping documentation. It helps determine:

What duties or taxes apply

If the product is allowed into a country

How customs officials categorize your shipment

Example:

6109.10 = Cotton t-shirts

The Country of Origin is the country where your product was manufactured, produced, or substantially transformed – not necessarily where it’s shipped from.

This is important for determining:

Import duties

Trade agreements

Compliance with regulations

In short:

If you only ship to your own country: No

If you ship internationally: Optional (see below)

If you sell physical products and ship internationally, then you will likely need to enter the HS code and country of origin when shipping your product. Currently CartGenie can’t send this info directly to Shippo (due to their API limitations), but we can help you keep track of the correct code for each product so you have it ready you’re shipping.

Where Can I Find My Product’s HS Code?

Where Can I Find My Product’s HS Code?You can search for your product’s HS code using these tools:

Look for a code that most closely matches the description of your product.

Adding accurate HS Codes and Country of Origin can speed up customs clearance, reduce the risk of delays or unexpected fees to you or your customers, and ensure you’re compliant with international shipping regulations.