By connecting your CartGenie store with TaxJar, you can automatically calculate the correct sales tax for every order based on your customer’s location and your store’s tax settings. This saves you time, reduces the risk of errors, and keeps you compliant with local tax laws – whether you sell in one state or across multiple regions.

As of now, TaxJar calculates and manages sales tax only for the United States  .

.

For US-based stores selling internationally, TaxJar will apply tax to US orders only.

If you need to calculate sales or VAT taxes for other regions, we suggest using the “Custom” tax calculation method in CartGenie instead.

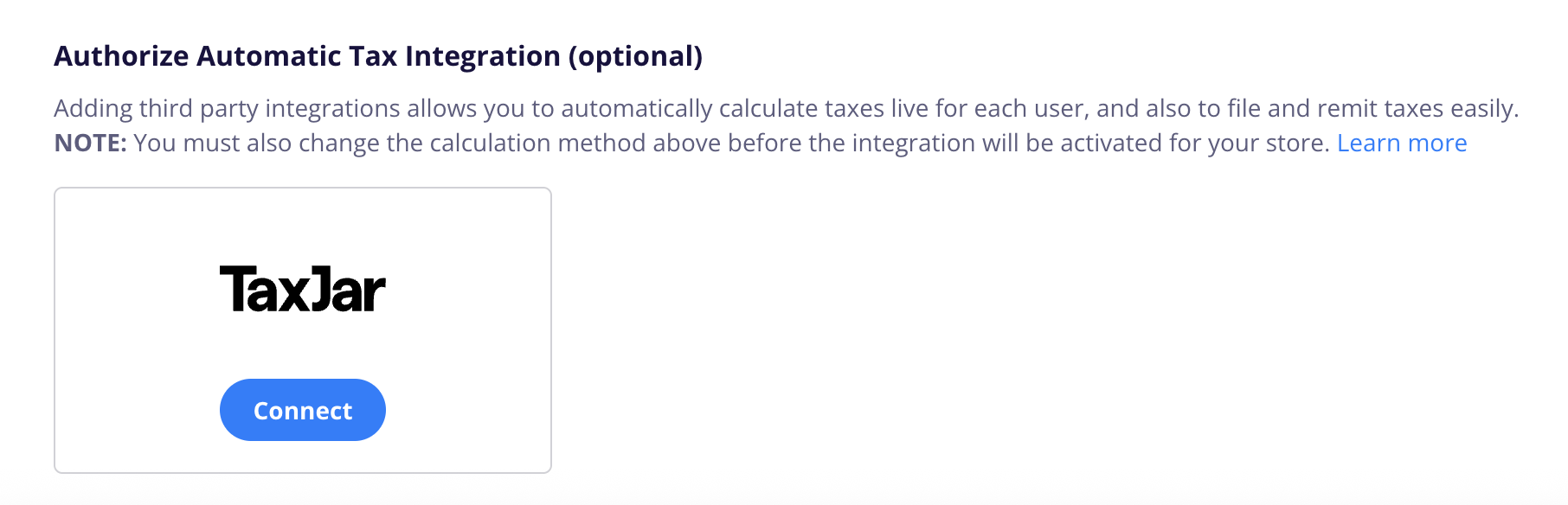

In CartGenie, go to Settings > Taxes and click the “Connect” button on the TaxJar card.

Open Tax Settings

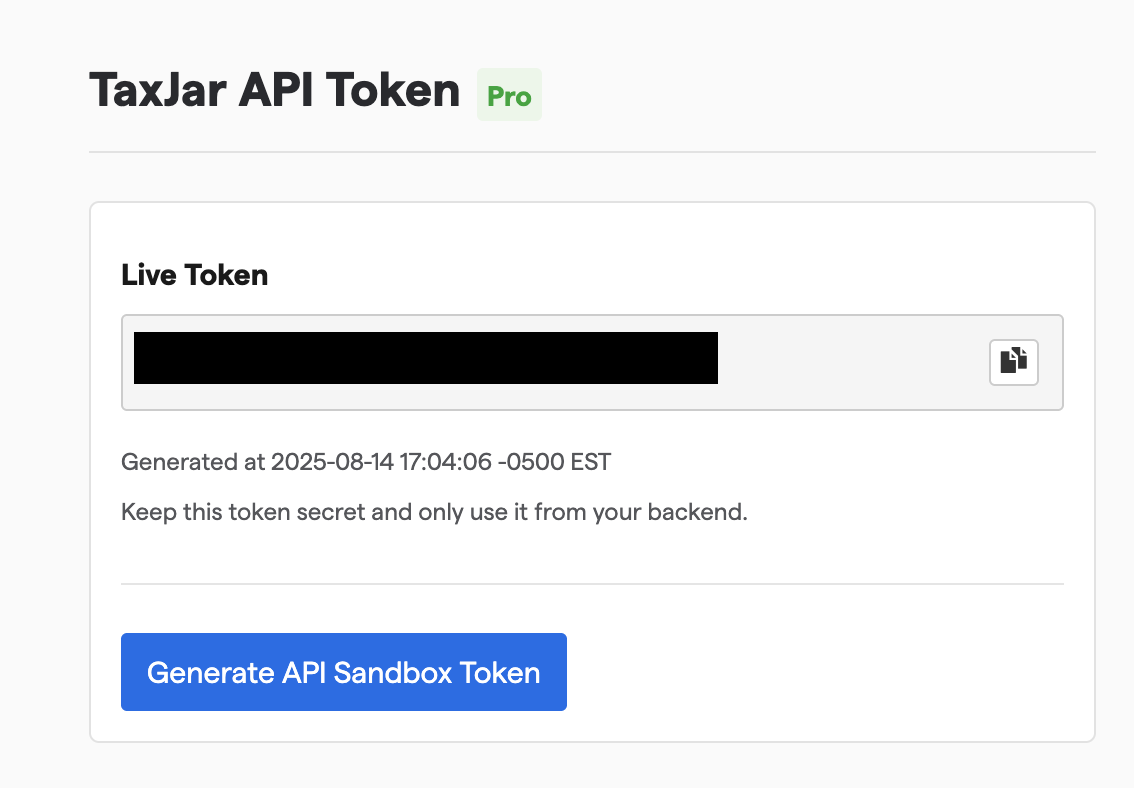

Enter your TaxJar API key.

You can find your TaxJar Live Token API key by going to https://app.taxjar.com/account#api-access

While you’re on the TaxJar API page, be sure to enter your Nexus address(es) if you haven’t already. This is required for TaxJar to calculate your taxes accurately.

Learn about what constitutes a nexus here.

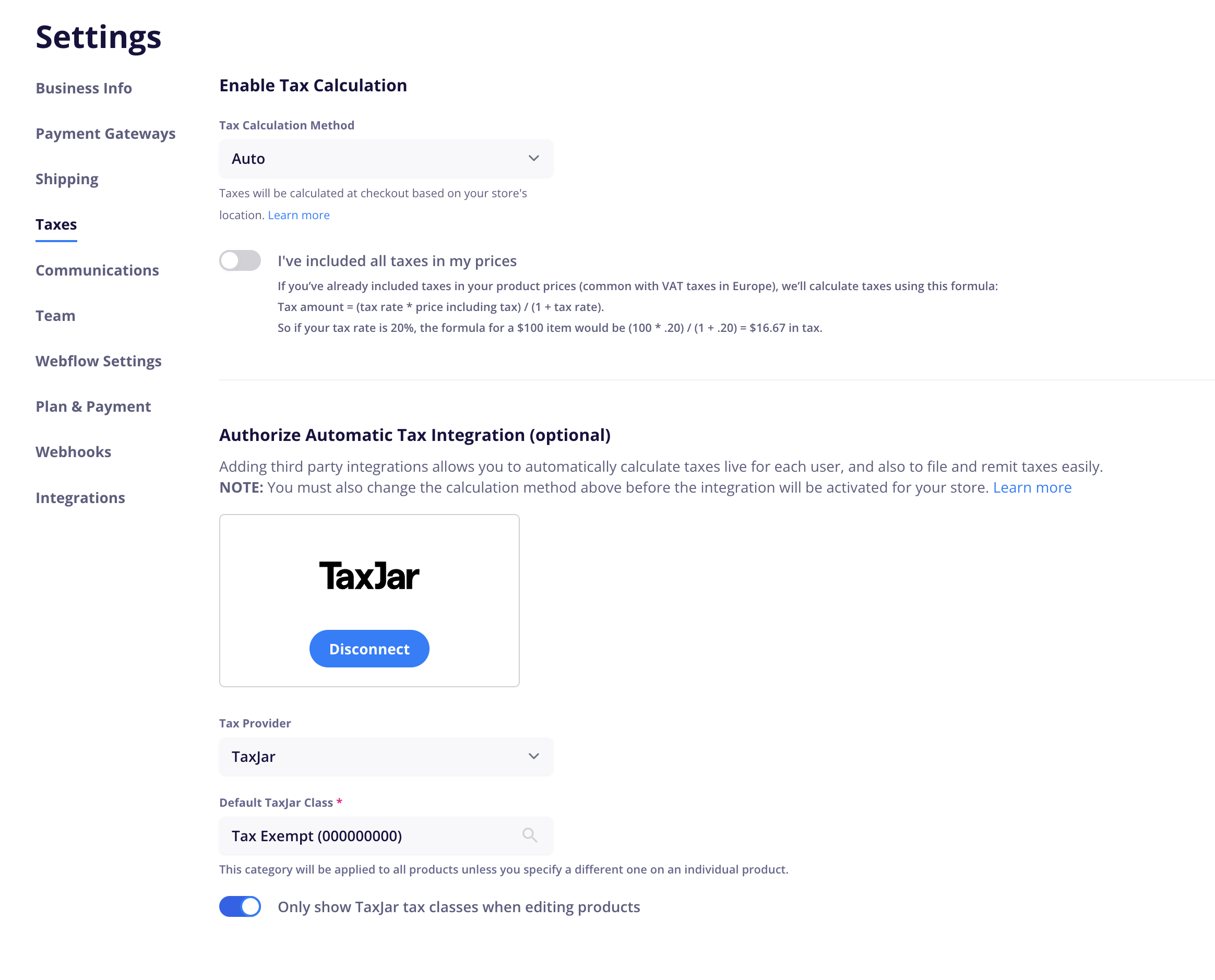

Go to your CartGenie Settings > Taxes page and switch Tax Calculation Method drop down to “Auto”.

Change Tax Calculation Method

Tax classes determine what rate a product is taxed at. Each U.S. state charges a different rate for sales tax depending on these classes. (Example: fresh groceries are often tax exempt in most states). So it is important that you set the tax class that most accurately represents your products.

Click the “Default TaxJar Class” drop down to set your preferred default TaxJar class that will be applied to all products. You can then modify this tax class for each individual product later.

You can click in the dropdown to directly search all available options or you can search on TaxJar’s website here.

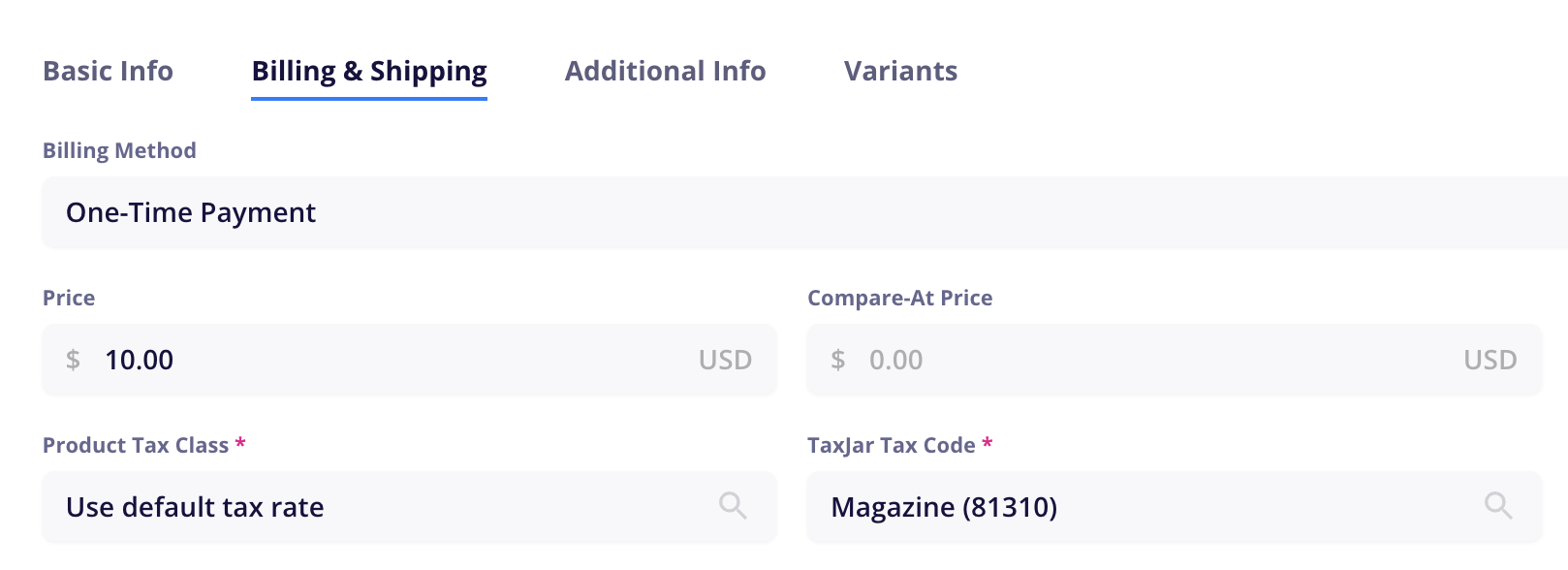

If you have a variety of products that require a different tax class than your default, you will need to set that manually on each one. Go to your products list in CartGenie.

Go to ProductsOpen each product and navigate to the Billing & Shipping tab. You’ll now see a new box for “TaxJar Tax Code”.

Click into the TaxJar Tax Code dropdown and select the appropriate class for each product. Be sure to Publish the product once done.

Done! Your TaxJar set up is complete. If you go to your live site and initiate a checkout, you should be able to enter a shipping address and see the live tax rate calculated at checkout.

Note: Most of the time sales tax is only charged in the same state as your nexus, so enter an address in the same state as your business to see sales tax at checkout – or enter a different state to see if sales tax is hidden correctly.

Once integrated, CartGenie sends order details (like shipping address and order total) to TaxJar. TaxJar then returns the correct sales tax amount in real-time, which is applied at checkout. You’ll get:

Accurate tax rates for every supported region

Automatic updates when tax laws change

Peace of mind knowing your rates are always up to date