Want CartGenie to add sales tax or VAT at checkout? You can either disable all taxes or set up your tax jurisdictions and rates so we can calculate it for you at checkout.

By default, all stores start with tax calculation turned off (effectively) because until you add a taxable jurisdiction, no taxes will be calculated at checkout.

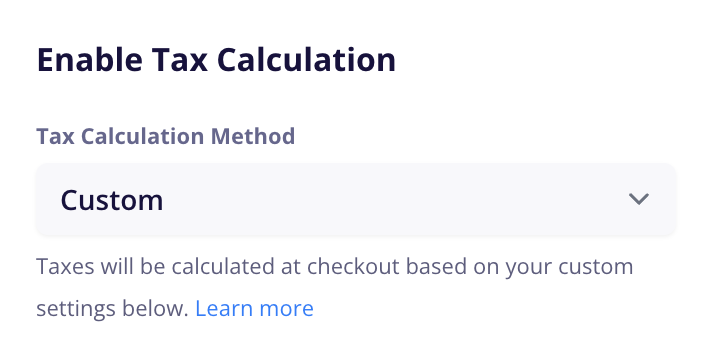

The “Custom” calculation method allows you to manually create taxable jurisdictions and set the amount of sales taxes / VAT you want to collect for customers in that jurisdiction. This also allows you to create custom product tax classes in order to charge specific rates on individual products.

The rest of this help doc below centers around the “Custom” tax calculation.

The “Auto” calculation method allows you to integrate your CartGenie store with a 3rd party software such as TaxJar for automatic tax calculation at checkout. Read more here:

Integrating CartGenie with TaxJar for automatic sales tax calculation

Let TaxJar automatically calculate the correct tax for your customers at checkout

A taxable jurisdiction refers to any location where a business is required to collect and remit sales tax, VAT, or GST. This depends on factors like physical presence, sales thresholds, and local tax regulations.

Where Might a Business Need to Pay Taxes?

United States

Businesses may need to collect sales tax in any states where they have a physical or economic nexus. Marketplace facilitators may also be responsible for tax collection. A few examples of activities that might warrant being considered a taxable jurisdiction are (but not limited to):

Physical Nexus: A business has a physical presence in the state, which can include: Headquarters, office, or retail store; Warehouse or storage facility; Employees, sales reps, or contractors working in the state; Manufacturing or distribution centers; Owning or leasing property in the state

Economic Nexus: A business exceeds a state’s sales or transaction threshold, typically 100,000 in sales OR 200 transactions in a year (thresholds vary by state); Some states have different thresholds (e.g., $500,000 in California)

Inventory Nexus: If a business stores goods in a third-party warehouse or fulfillment center (such as Amazon FBA), it creates nexus in that state, even if the business has no other presence there.

Europe (EU & UK)

Businesses selling to EU or UK customers may need to register for VAT (Value-Added Tax) in the country where the buyer is located. The One-Stop Shop (OSS) system simplifies VAT reporting across EU countries.

Canada

Canada has a federal Goods and Services Tax (GST) and Provincial Sales Tax (PST) or Harmonized Sales Tax (HST) depending on the province. Businesses may need to register for GST/HST if they exceed $30,000 CAD in annual sales. Some provinces, like British Columbia and Quebec, have separate PST rules.

Australia

Businesses selling to Australian customers must register for Goods and Services Tax (GST) if their annual sales exceed $75,000 AUD. This applies to both domestic and international sellers providing goods or digital services.

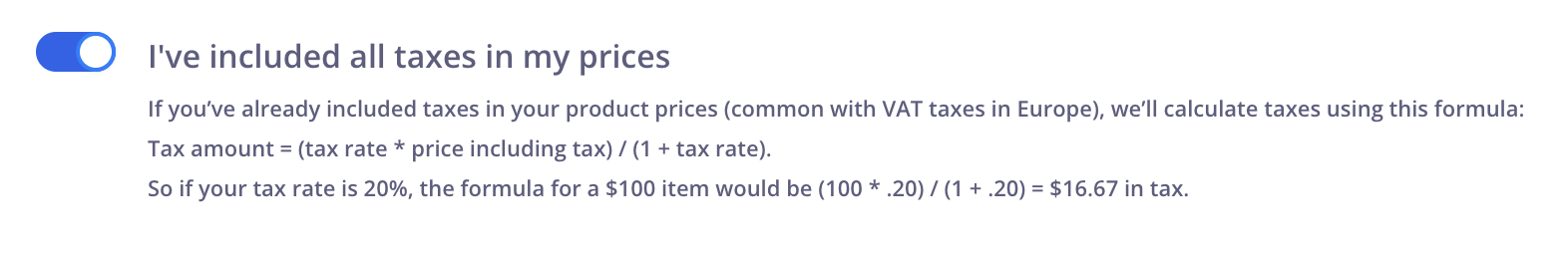

If you live in a country which tends to list prices as tax-inclusive, you can enable that option here. If this option is enabled, we don’t add any tax amount onto an order’s total.

An order’s tax is calculated as = (tax rate * price including tax) / (1 + tax rate)

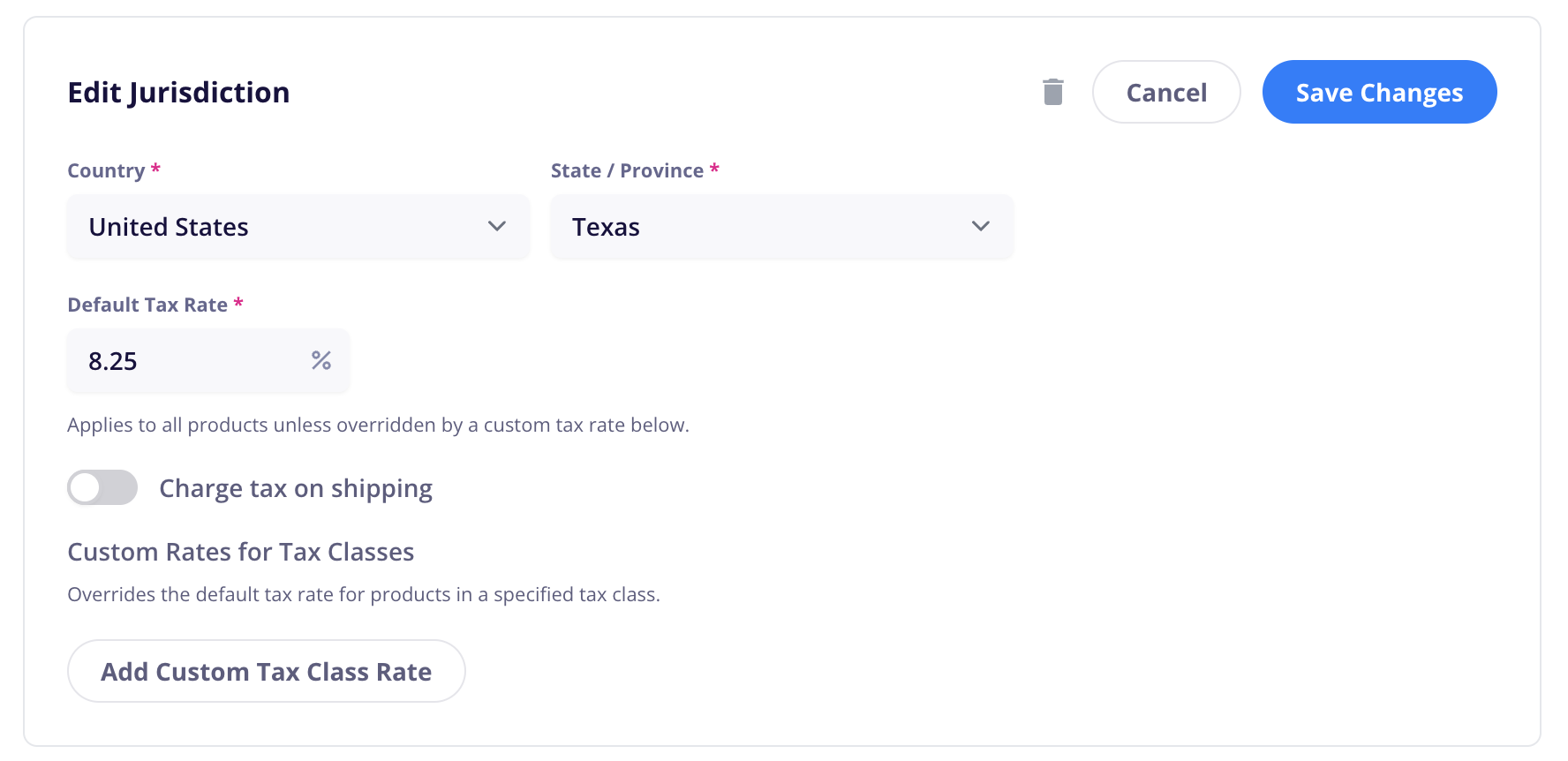

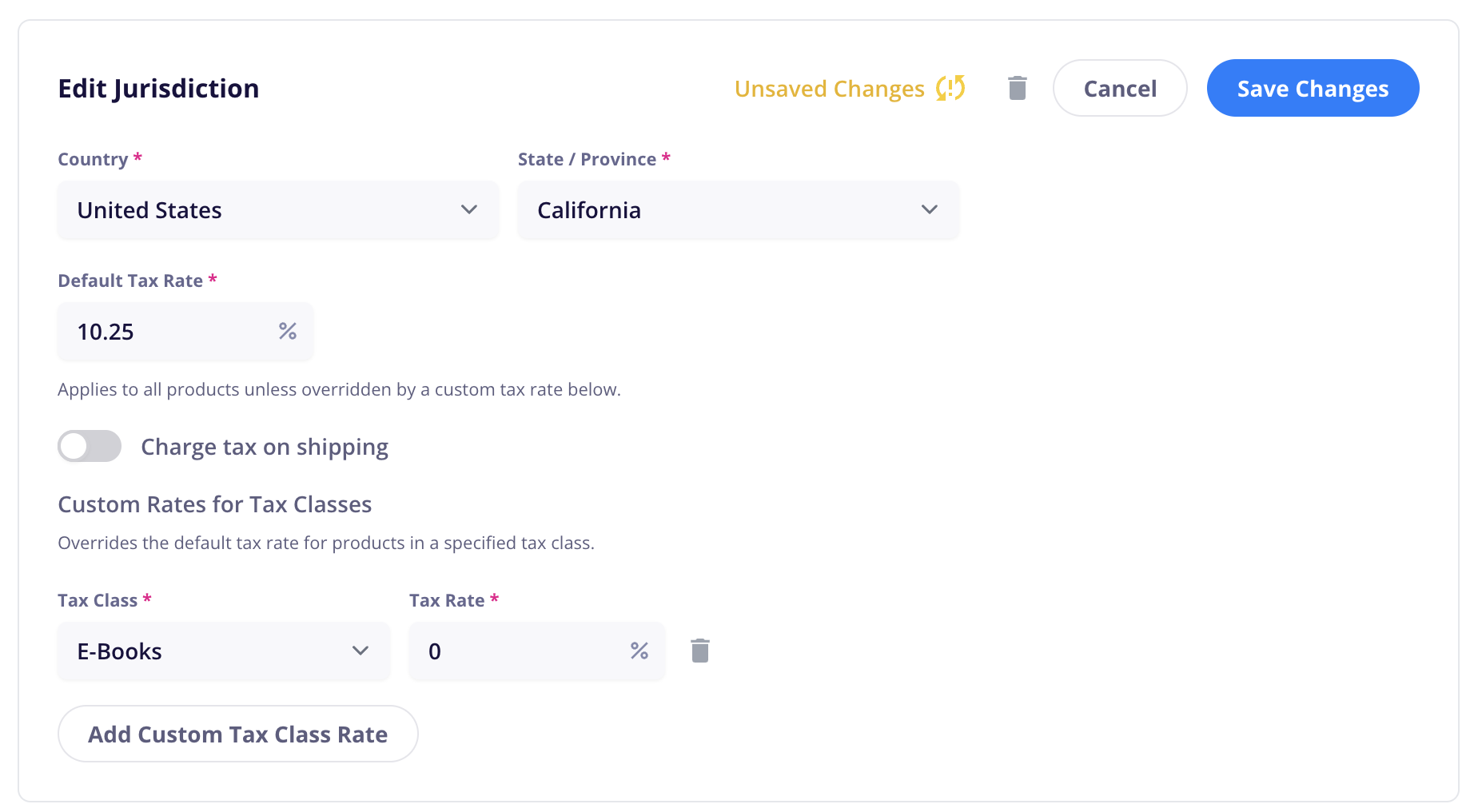

To add a taxable jurisdiction, click on the “Add Jurisdiction” button and a panel will open with a few options.

Country: The country in which you have a taxable jurisdiction

Each jurisdiction can only contain a single country. If you have a nexus in multiple countries, please add each as a separate jurisdiction.

State / Province: The state or province in which you have a taxable jurisdiction

Each jurisdiction can only contain a single state. If you have a nexus in multiple states, please add each as a separate jurisdiction.

Default Tax Rate: The default rate for the selected jurisdiction.

This is the rate which CartGenie will use to calculate taxes for any orders being shipped to this jurisdiction

USA: Sales tax can vary within a state depending on the county or city. If you’re required to collect sales tax and you're not sure which rate to apply, it may be helpful to use the highest rate within your state to be safe. However, it is always best to check with a local tax professional. (CartGenie does not give tax advice. Each store is responsible for its compliance with local laws and regulations.)

Charge tax on shipping: If disabled (default), the tax rate will be calculated only on sum of the product prices purchased. If enabled, the tax rate will be calculated on the subtotal + shipping.

Custom Rates for Tax Classes: You can set a custom rate within each jurisdiction for specific products that may fall into special categories (see section on “Tax Classes” further down).

Some products have sales tax rates that differ from the default rate due to special tax rules, exemptions, or reduced rates. Consult with resources or a tax expert in your area to understand if this might apply to your products.

A few examples of these for the United States are (but not limited to):

Digital Products & Software

E-books & audiobooks – Exempt in some states, taxed in others

Online courses & educational materials – Often tax-free if they don’t include physical goods

Stock photos, videos, and graphics – Lower or exempt, depending on the state

Software licenses & SaaS subscriptions – Taxable in many states, but some states exempt SaaS

Website themes, plugins, and templates – Often taxed at a lower rate or exempt

Subscription Boxes & Memberships

Subscription-based access to premium content – Often tax-free if digital-only

Monthly mystery boxes (e.g., snacks, collectibles, books) – Taxable if they contain physical goods

Online coaching & consulting memberships – Usually tax-free

Specialty Food & Beverages

Rare or imported snacks & beverages – Tax-exempt or lower rate in many states

Meal replacement shakes & health supplements – Taxable in some states, exempt in others

Specialty coffee, tea, or gourmet chocolate – Exempt if unprepared, taxable if prepackaged

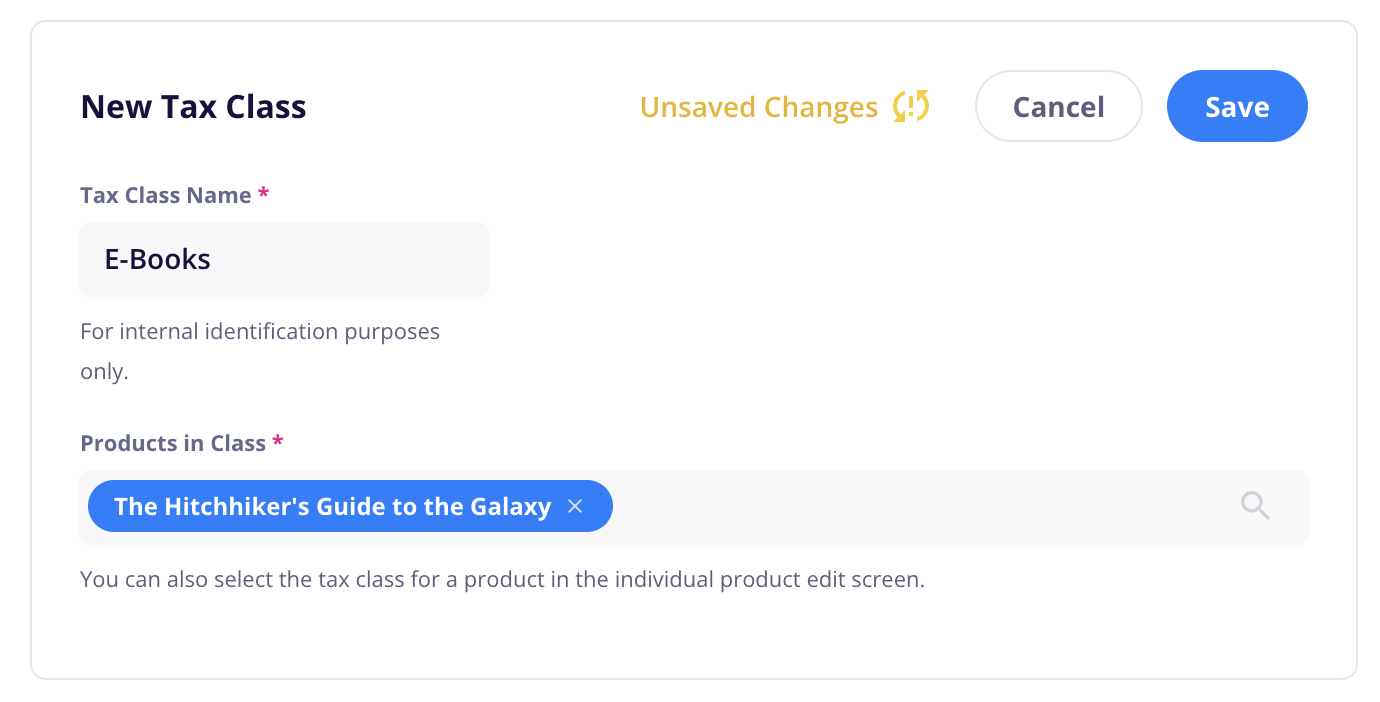

You should add a tax class for any product that is taxed at a different rate than the default rate for your jurisdictions.

Products can only be added to a single tax class.

To add a tax class, click on the “Add Tax Class” button

Tax Class Name: This is an internal only title to help identify your class.

Products in Class: All products which should be included in this tax class

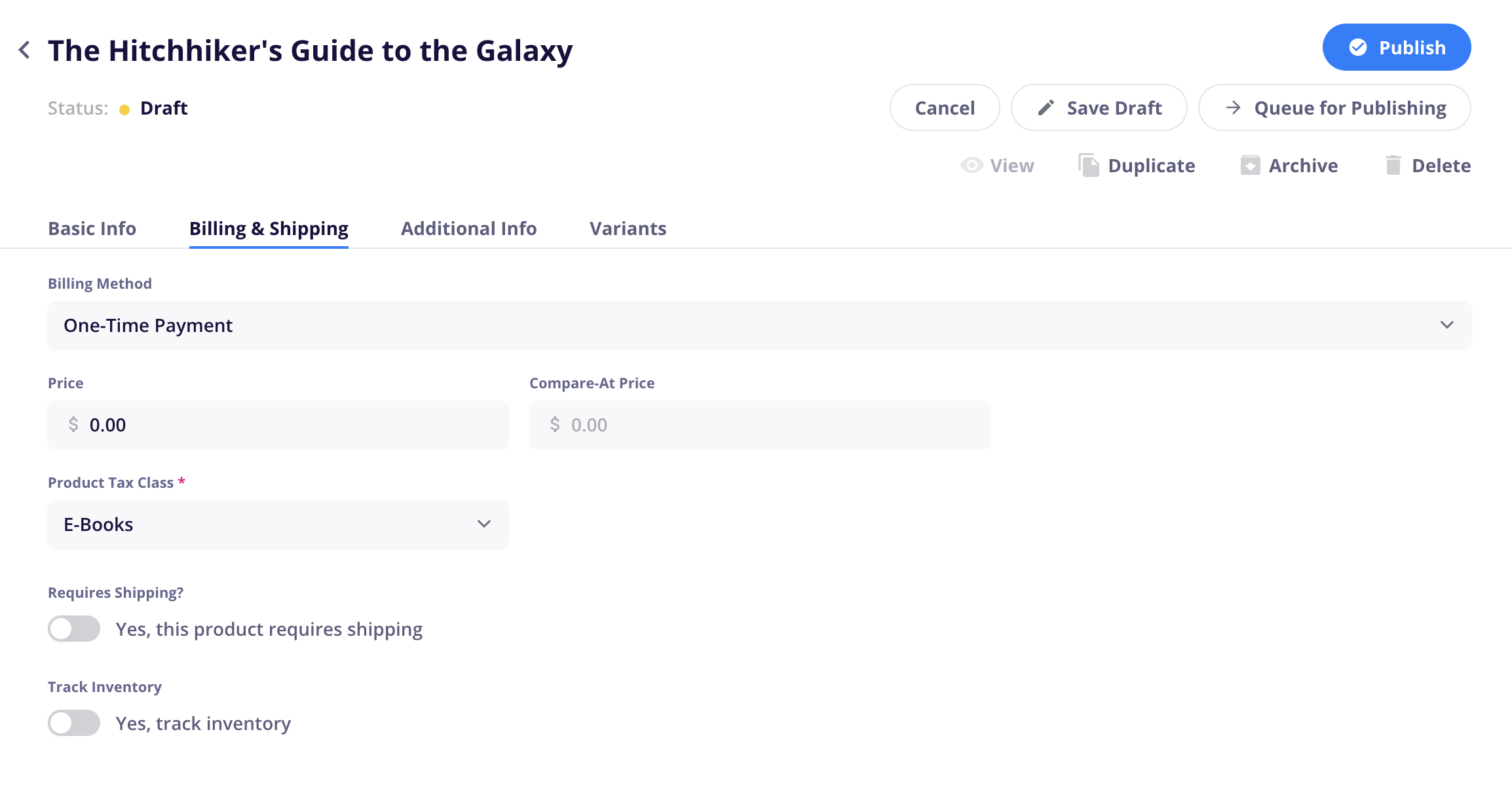

You can also add a product to an already created tax class when creating or editing it in the Products detail panel under “Billing & Shipping”.

After you’ve added all your tax classes, you can now set a custom rate for each class in your taxable jurisdictions.

Open the jurisdiction you wish to edit and click the “Add Custom Tax Class Rate” button.

Select your tax class(es) and set their custom rate.

Save your changes.

Sales tax can vary within a U.S. state depending on the county or city. If you’re required to collect sales tax and you're not sure which rate to apply, it may be helpful to use the highest rate within your state to be safe. However, it is always best to check with a local tax professional. (CartGenie does not give tax advice. Each store is responsible for its compliance with local laws and regulations.)

Or you can use ChatGPT to research a recommended rate for your location & store specifically . Use a prompt like:

I'm a vendor named [NAME], registered in [LOCATION]. I need to identify the correct amount of sales tax to charge for sales in [STATE]. I'm selling a [PRODUCT or SERVICE] of [DESCRIPTION]. What rate should be added to the sale for sales tax?"Last Updated: June 2025 (Check for latest rates)

State | Highest Rate | State Base rate | Total range (State + Local) |

Alabama | 11.0% | 0%–7% | 4%-11% |

Alaska | 7.5% | 0% | 0%–7.5% |

Arizona | 11.2% | 5.60% | 5.6%–11.2% |

Arkansas | 11.5% | 6.50% | 6.5%–11.5% |

California | 10.25% | 6.00% | 7.25%–10.25% |

Colorado | 11.2% | 2.90% | 2.9%–11.2% |

Connecticut | 6.35% | 6.35% | 6.35% |

Delaware | 0.0% | 0% | 0% |

Florida | 8.0% | 6% | 6%–8% |

Georgia | 9.0% | 4% | 4%–9% |

Hawaii | 4.5% | 4% | 4%–4.5% |

Idaho | 9.0% | 6% | 6%–9% |

Illinois | 11.0% | 6.25% | 6.25%–11% |

Indiana | 7.0% | 7% | 7% |

Iowa | 8.0% | 6% | 6%–8% |

Kansas | 10.6% | 6.50% | 6.5%–10.6% |

Kentucky | 6.0% | 6% | 6% |

Louisiana | 11.45% | 4.45% | 4.45%–11.45% |

Maine | 5.5% | 5.50% | 5.50% |

Maryland | 6.0% | 6% | 6% |

Massachusetts | 6.25% | 5.60% | 6.25% |

Michigan | 6.0% | 6% | 6% |

Minnesota | 8.375% | 6.88% | 6.875%–8.375% |

Mississippi | 8.0% | 7% | 7%–8% |

Missouri | 10.1% | 4.23% | 4.225%–10.1% |

Montana | 0.0% | 0% | 0% |

Nebraska | 7.5% | 5.50% | 5.5%–7.5% |

Nevada | 8.265% | 4.60% | 4.6%–8.265% |

New Hampshire | 0.0% | 0% | 0% |

New Jersey | 6.63% | 6.63% | 6.63% |

New Mexico | 9.0625% | 5.13% | 5.125%–9.0625% |

New York | 8.875% | 4% | 4%–8.875% |

North Carolina | 7.5% | 4.75% | 4.75%–7.5% |

North Dakota | 8.5% | 5% | 5%–8.5% |

Ohio | 8.0% | 5.75% | 5.75%–8% |

Oklahoma | 11.5% | 4.50% | 4.5%–11.5% |

Oregon | 0.0% | 0% | 0% |

Pennsylvania | 8.0% | 6% | 6.0%–8.0% |

Rhode Island | 7.0% | 7% | 7% |

South Carolina | 9.0% | 6% | 6%–9% |

South Dakota | 6.5% | 4.50% | 4.5%–6.5% |

Tennessee | 10.0% | 7% | 7%–10% |

Texas | 8.25% | 6.25% | 6.375%–8.25% |

Utah | 8.7% | 4.70% | 4.7%–8.7% |

Vermont | 7.0% | 6% | 6%–7% |

Virginia | 7.0% | 4.30% | 4.3%–7% |

Washington | 10.4% | 6.50% | 6.5%–10.4% |

Washington, D.C. | 6.0% | 6.00% | 6% |

West Virginia | 7.0% | 6% | 6%–7% |

Wisconsin | 5.6% | 5% | 5%–5.6% |

Wyoming | 6.0% | 4% | 4%–6% |